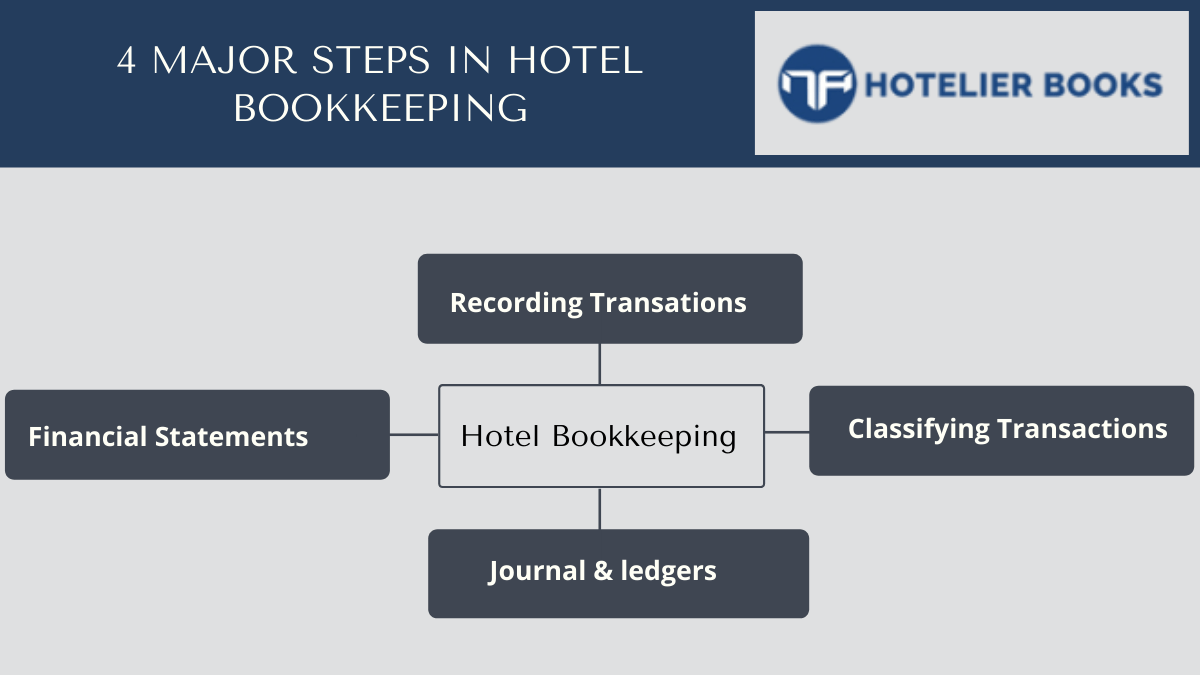

There are four main steps in hotel bookkeeping, which include: recording transactions; classifying transactions; posting the recorded transactions to journals and ledgers; and preparing financial statements.

Step 1: Recording Transactions

Recording transactions includes every action taken by the hotel’s employees and owners during their day-to-day operations. For instance, receiving payments from checking out guests or paying bills for supplies. All of these events have to be recorded as an entry into an accounts receivable account or an accounts payable account on the corporation’s general ledger, respectively. In other words, all financial documents generated by these actions must be kept as proof that the company made those purchases, generated those earnings, etc., even though it might have been months ago.

Step 2: Classifying Transactions

Classifying transactions is where its gets a little more technical and complicated. For example, when recording how much money guests paid for their room keys, this would be classified as cash revenue in the cash receipts journal. However, if they gave an IOU because they didn’t have any small bills to make change, this would be classified as accounts receivable in the same journal (debit). Another common transaction found in hotel books includes matching up food and beverage costs with revenue from selling meals and drinks to guests at each meal. Both of these items should fall under “operating expenses,” which include any costs that aren’t directly related to purchasing or selling inventory or generating revenue/profit, but are required for general day-to-day operations.

Step 3: Posting the Recorded Transactions to Journals and Ledgers

Posting transactions, which is more of a mechanical action, occurs when each of the company’s entries are transferred from their individual journals into their respective accounts in the corporation’s general ledger. For example, all cash receipts recorded in the cash receipts journal should be transferred to an account called “cash” under assets on its general ledger before being included in that month or year’s income statement. The same goes for expenses–all costs/expenses incurred by the business should be posted to an account called “expenses” under liabilities on its balance sheet before being lumped together with other operating expenses in preparing the income statement.

Posting to the general ledger might involve transferring data from one account in a journal to multiple accounts under liabilities or assets on its balance sheet, but there’s no need for this information to be transferred into any other journals besides the cash receipts and cash disbursements journals.

Step 4: Preparing Financial Statements

Preparing financial statements can go by many names including report writing, reporting, closing entries, etc., but they all have the same purpose: To summarize everything that occurred during a month/year so management can determine whether the business made a profit or took a loss within that time frame. In fact, you don’t even have to call them “financial” statements anymore because any summary of what happened inside a business (i.e. monthly production reports, quarterly sales reports, etc.) should be prepared to help managers make these decisions at any level of detail they prefer. For example, managers might review daily production data to find out if the employees working on a specific machine are producing too much or not enough product in comparison with others.

As you can tell by the name, closing entries are the last accounting entry made for each account during a given month/year in a corporation’s books before preparing financial statements and beginning the process all over again in the next month/year. In other words, when a new month begins in a hotel’s books, it needs to have an opening balance equal to its ending from the previous month so that it can continue to track and record transactions for the new month.

There are four basic steps involved in bookkeeping: recording, classifying, posting to journals and ledgers, and preparing financial statements.

Recording is exactly what it sounds like–it’s the first step of bookkeeping where transactions (i.e., purchases, revenue/income, etc.) are officially put into a company’s books by an accountant or bookkeeper. The second step is classification because it’s necessary to analyze each transaction and determine whether these items should be classified as cash or inventory under current assets on its balance sheet, accounts receivable or liabilities on its balance sheet, sales or revenue under income on its income statement, operating expenses or cost of goods sold under expenses on its income statement, etc.

Step 3 is posting the recorded transactions to journals and ledgers which might be more of a mechanical action involving transferring each entry from their individual journal into their respective accounts under liabilities or assets on its balance sheet.

The final step is preparing financial statements by summarizing what happened in each account during a given time frame so management can determine whether the company made/lost money within that month/year.

Hotelier Books takes care of your bookkeeping, where you can leave the rest and focus more on guests. Schedule a demo to see how it works! hotelierbooks.com